Best Gold IRA Investments Companies Reviewed

Noble Gold Group: Expert Review 2024

In the era of restricted choices for investing in precious metals and securing essential services, Noble Gold emerges as a one of the forefront of reliability and opportunity. What distinguishes Noble Gold from its competitors?

Through my extensive research throughout many companies, I've come to recognize Noble Gold as a dependable ally for US citizens, owing to its steadfast commitment to delivering value, trustworthiness, and an extensive range of tailored services.

Noble Gold Investments was established with a fundamental ethos focused on empowering clients and protecting their wealth.

They offer a wide range of investment opportunities in precious metals, comprehensive survival packages, cutting-edge storage facilities, and reasonable minimum investment thresholds, solidifying Noble Gold's position at the forefront of the industry.

Yet, the critical inquiry persists: is Noble Gold the optimal choice for your investment aspirations? Join me as we embark on a thorough exploration to provide you with the clarity needed to make an informed decision.

Top 3 Gold Investment Companies Reviewed

Unearthing the Truth: The Public Perceptions of Noble Gold Group

Nearly all companies receive negative reviews. Negative reviews are a common occurrence for many companies because it is impossible to please everyone all the time.

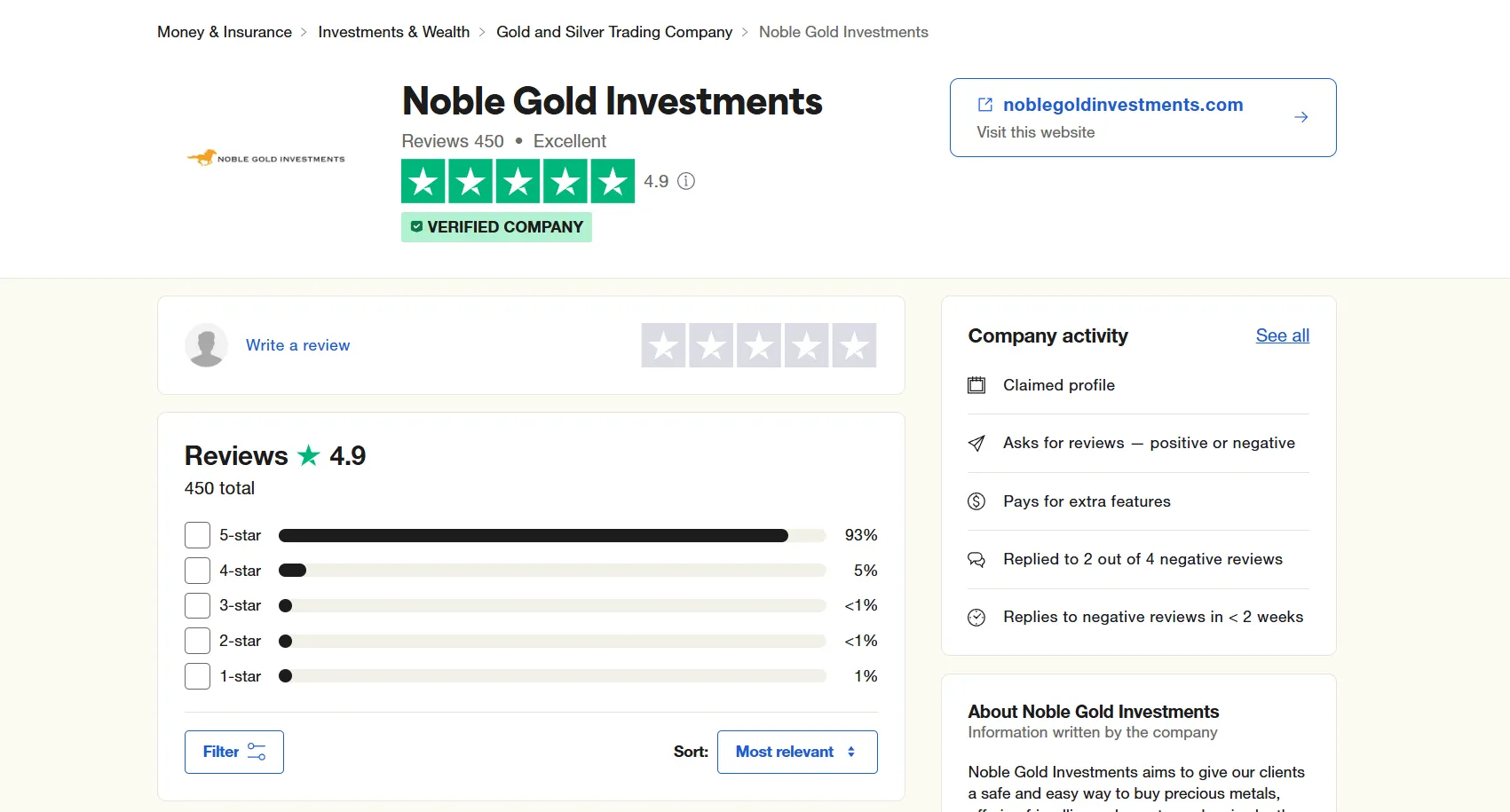

Customer feedback, both positive and negative, can provide valuable insights. Below are the ratings from multiple companies to give you a clear insight.

Trustpilot rating of 4.9 stars based on 450 reviews further reinforces the company's reliability.

Positive reviews often highlight the knowledgeable customer service provided by Noble Gold Investments and the ease of application, funding, and purchasing metals, contributing to the company's reputation for financial stability and customer satisfaction.

While Noble Gold Investments is a privately held company with no online financial statements available, its accreditation with the Better Business Bureau (BBB) since 2017 and an A+ rating, along with a BBB rating of 4.98 stars based on 191 reviews, indicate a high level of trustworthiness.

Ensuring financial stability and trustworthiness is imperative for investors considering precious metals, especially when evaluating the credibility of a company like Noble Gold Investments.

Birch Gold Group Ratings

-

BBB Rating:

4.98/5 A + reviews - bsed on 191 reviews - 99.6% positive rating

-

Trustpiot:

4,9/5 rating based on 450 reviews - 91% 5-star reviews

-

Consumer affairs:

4.9/5 rating from 789 reviews - 98% 5-star reviews

-

Business Consumer Alliance:

AAA rating 100% 5 star reviews - based on 4 reviews

Noble Gold's Industry Recognition

Noble Gold has earned notable industry recognition for its honourable length in the gold IRA sector. With a solid foundation in California, our company has swiftly become a trusted house hold name in the industry.

Under the leadership of CEO Collin Plume, boasting 22 years of finance expertise, Noble Gold specializes in gold and silver IRAs. We offer tax-efficient self-directed IRAs for precious metals, ensuring the security and growth of our clients' investments. They have secured more than $1 billion for their customers over they year.

Partnering with IDS for secure gold storage and Equity Trust as the preferred IRA custodian, they prioritize the safety and reliability of our services. Noble Gold's commitment to excellence has positioned us as a standout choice for individuals seeking to secure their financial future with precious metals.

Noble Gold's commitment to transparency and customer satisfaction sets them apart in the gold IRA industry. Their team of dedicated experts provides personalized guidance to help clients make informed decisions about their investments.

They understand the importance of safeguarding wealth for the future, which is why we offer a range of options tailored to meet the diverse needs of our clients.

Whether it's diversifying a retirement portfolio or protecting assets against economic uncertainties, Noble Gold is dedicated to delivering exceptional service and peace of mind to those looking to secure their financial well-being through precious metals.

Noble Gold Fees and Pricing

Exploring the fee structures and pricing at Noble Gold reveals competitive options for gold and silver IRAs. Opening an IRA with Noble Gold incurs no charges, with a reasonable annual custodial fee of $80.

When it comes to storage, annual fees apply for gold held in Delaware Depository or Texas Bullion Depository, with specific details for silver IRA fees available upon inquiry.

While Noble Gold lacks full pricing transparency on its website, the company's fee structures are generally competitive within the industry. This aspect may be a consideration for individuals looking to invest in precious metals through a reputable and established company like Noble Gold.

Frequently Asked Questions

When choosing the right custodian for your Gold IRA, it's essential to embark on comprehensive research and ask many questions regarding, fee structures, storage choice, Ensure they adhere to IRS regulations. Before making an informed decision. Noble Gold Group’s financial adviser will guide you through the process

Noble Gold Investments offers special promotions such as a free investment kit for clients, a guaranteed buyback program, trusted advisors, and quick IRA setup. By prioritizing education over sales tactics, clients receive valuable insights for informed investment decisions

Yes, you can pass on your Gold IRA to your heirs, providing a valuable legacy. By designating beneficiaries, your loved ones can inherit your assets, potentially enjoying the benefits of gold's long-term value appreciation

Storage restrictions for a Gold IRA depend on IRS guidelines. Approved depositories ensure security and compliance. Restrictions may apply to storing metals at home. Consult Noble Gold for expert advice on storing IRA gold to safeguard your investment.

In the event of an economic collapse, a Gold IRA can act as a safeguard for your retirement savings. Gold's intrinsic value tends to increase during crises, providing a potential hedge against financial instability

Conclusion

Before investing in gold, it's essential to conduct thorough research. Analyze market trends, learn how gold responds to economic shifts, and evaluate the costs of a gold IRA. Consider your financial objectives and risk tolerance to make informed choices, ensuring that gold aligns with your broader investment plan.

Copyright © Peter G. Sanders 2020