Best Gold IRA Investments Companies Reviewed

Birch Gold Group: Tripple A Business Consumer Rating 2024

Are you seeking stability and growth in your investment portfolio? Birch Gold Group beckons, offering a pathway to fortify your financial standing with precious metals.

Safeguarding your wealth with Birch Gold Group by your side. Their team of knowledgeable experts can guide you through the intricacies of investing in precious metals, helping you navigate market fluctuations and potential economic uncertainties.

But what sets them apart? Unravel the nuances of their investment solutions and discover how they can align with your unique financial goals. With a reputation built on trust and expertise, Birch Gold Group may just hold the key to unlocking a more secure financial future for you.

Whether you are looking to hedge against inflation, geopolitical risks, or simply diversify your portfolio, Birch Gold Group stands ready to provide you with the tools and knowledge necessary to make informed decisions about your financial future.

Take the first step towards a more resilient investment strategy by exploring the possibilities with Birch Gold Group today.

What Do People Say About The Birch Gold Group

Discover what customers are saying about Birch Gold Investments to gain valuable insights into their experiences and satisfaction with the company's services.

Customers have praised Birch Gold for its knowledgeable staff who guide them through the investment process with clarity and transparency.

Many clients appreciate the personalized approach and the attention to detail that Birch Gold provides.

Some reviews highlight the ease of communication and the prompt responses received when reaching out to the company. Overall, customers seem to value the level of expertise and professionalism exhibited by Birch Gold Investments.

Reading through these reviews can help you gauge the quality of service and support you can expect when considering Birch Gold for your investment needs.

Birch Gold Reputaton and Customer Ratings

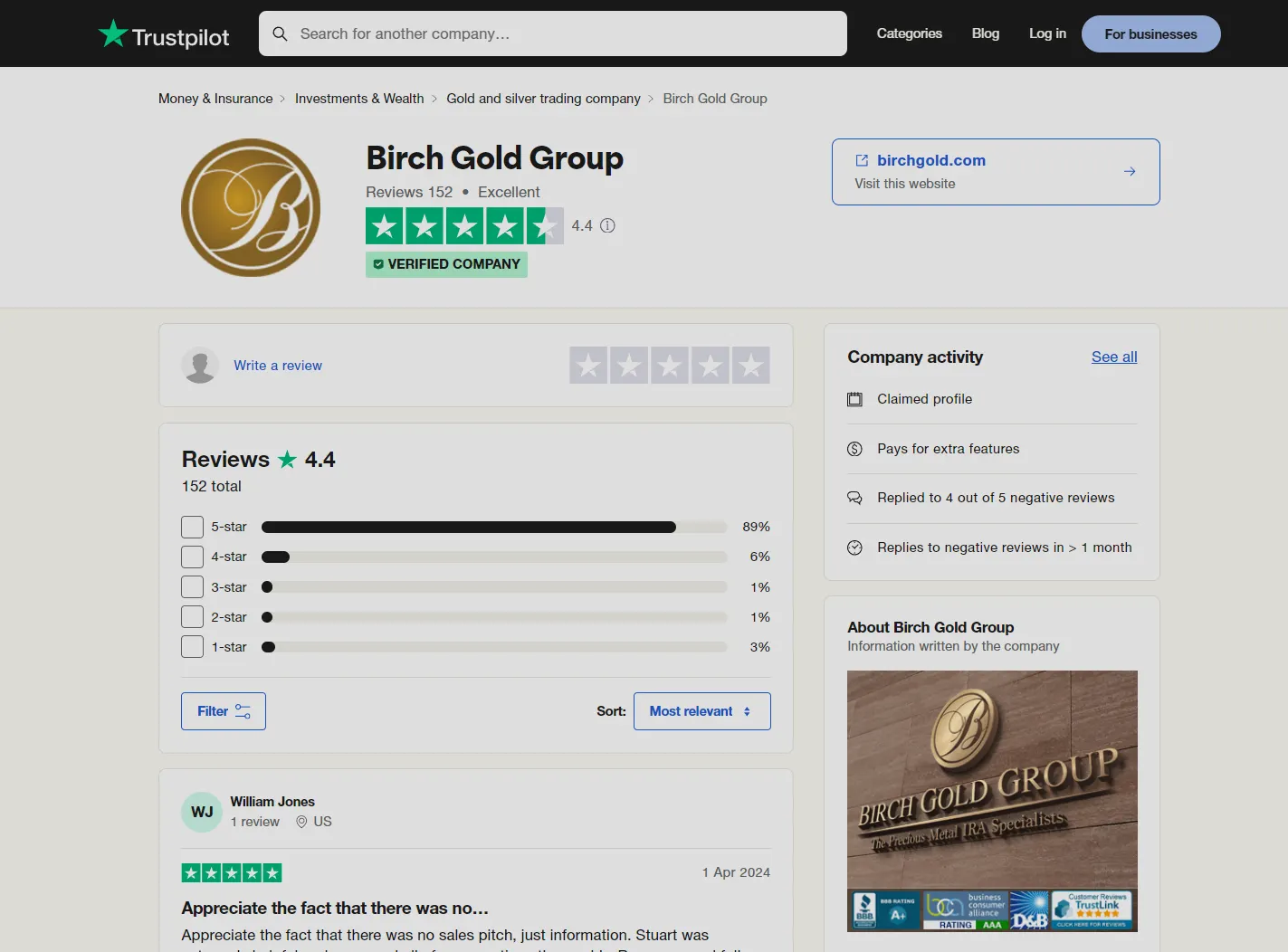

With a Trustpilot rating of 4.2 out of 5 from 138 reviews and a BBB rating of 4.59 out of 5 from 134 reviews, Birch Gold has garnered positive feedback regarding its reputation and customer service. These ratings reflect a generally satisfied customer base.

Birch Gold's A+ accreditation with the BBB further solidifies its reputation as a trustworthy company. The Google rating of 4.7 out of 5 from 260 reviews also contributes to the overall positive sentiment towards Birch Gold.

Customers have praised the company for its attentive customer service and diverse investment options. Birch Gold's availability from Monday to Friday, 8 a.m. to 7:30 p.m. CT, along with multiple communication channels for support, enhances its customer service experience.

Birch Gold Group Ratings

Birch Gold Group's ratings across various consumer sites reflect a positive reception from clients and organizations alike.

Customers of Birch Gold Group have consistently praised the company for its knowledgeable and helpful staff, transparent communication, and commitment to providing personalized service.

Many clients have expressed satisfaction with the company's, but with every company has a few customers that are still not happy with 5-star service.

Birch Gold Group has also garnered recognition from reputable organizations within the financial industry for its ethical business practices and dedication to client success. Overall.

The consensus across various consumer sites indicates a strong reputation for Birch Gold Group in the realm of precious metals investment.

-

BBB Rating:

A+ with 106 reviews.

-

Trustpiot:

4,4/5 rating based on 152 reviews - 88% 5-star reviews

-

Consumer affairs:

4.9/5 rating from 142 reviews - 98% 5-star reviews

-

Business Consumer Alliance:

AAA rating with no complaints.

Birch Gold Group IRA Fees

To further understand the financial implications of investing with Birch Gold Group, a detailed examination of their IRA fees is paramount. Here are some key points regarding Birch Gold Group IRA fees:

Annual fees for storage, insurance, and account management are applicable

A $200 annual fee is charged, regardless of the account size

One-time fees include an account set-up fee and wire transfer fee

Birch Gold Group covers the first-year fees on transfers exceeding $50,000

The pricing structure offers competitive rates within the precious metals IRA market

The breakdown of fees and costs associated with Birch Gold's services provides clarity on the financial aspects of investing in a gold IRA.

When setting up an account with Birch Gold, you can expect a one-time account setup fee of $50 and a wire transfer fee of $30. Additionally, there's an annual storage and insurance fee of $100, along with a management fee of $100 per year.

Notably, Birch Gold waives the first-year fees for transactions exceeding $50,000, offering potential cost savings for larger investments. Understanding these fees is crucial for making informed decisions about investing in a gold IRA with Birch Gold.

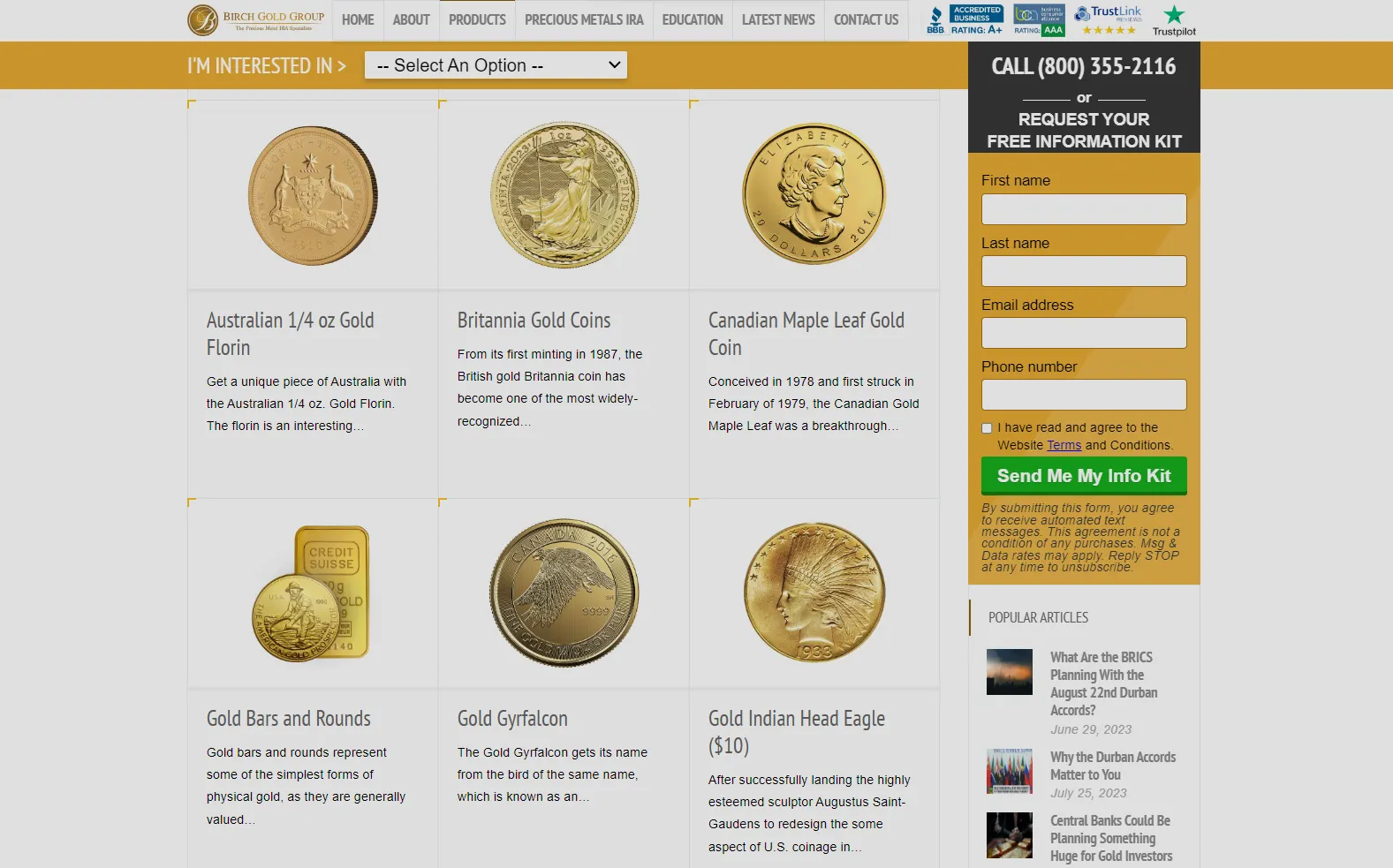

Birch Gold Group Coin Collection

Beyond mere monetary value, gold coins embody a rich tapestry of human history and artistic ingenuity. From ancient civilizations to modern-day mints, each coin tells a compelling story.

Birch Gold Group's offerings are no exception, meticulously chosen to reflect not only exceptional quality but also a profound connection to the past.

In the ever-evolving landscape of coin collecting, the allure lies not only in the intrinsic value of gold but also in the aesthetic appeal and historical significance of each piece.

Birch Gold Group recognizes this, curating a collection that transcends mere investment, offering a window into the fascinating world of numismatics

-

Gold American Bald Eagle Coin

-

Liberty Head Double Eagle Coin

-

Saint-Gaudens Gold Coin

-

Gold Rose Crown Guinea 1/4 oz

-

Gold Indian Head Eagle Coin

-

South African Gold Krugerrand

-

Gold Twin Maples Coin

-

Gold Polar Bear and Cub

-

Australian 1/4 oz Gold Florin Coin

-

Liberty Head (Coronet Head) collection

From the intricate designs of antiquity to the cutting-edge technologies of today, gold coins continue to captivate enthusiasts and investors alike. Birch Gold Group's commitment to excellence ensures that each coin they offer is not just a piece of precious metal but a tangible link to our shared heritage.

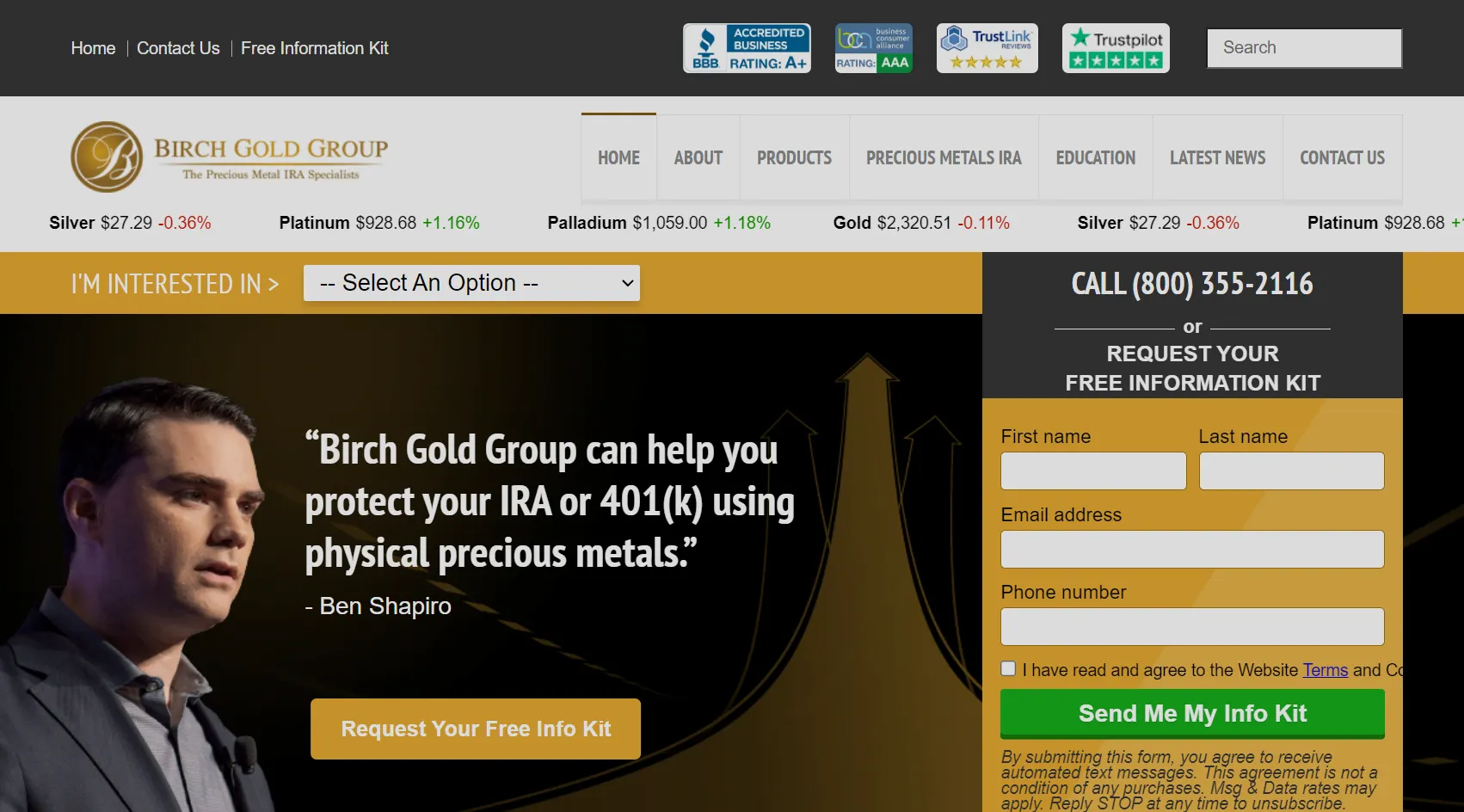

Birch Gold Group is honored to announce its partnership with Ben Shapiro, the esteemed host of the Ben Shapiro Show and Editor-in-Chief of The Daily Wire, who endorses our mission.

Recognizing the importance of securing one's retirement without fear, this collaboration aims to empower individuals with knowledge about their retirement savings alternatives.

Since August 2016, Birch Gold and Shapiro have joined forces to enlighten the public about the significance of tangible precious metals as a component of a diversified and safeguarded savings strategy.

One lesser-known facet of owning precious metals that Shapiro has championed is the ability to rollover an IRA or eligible 401(k) into an IRA backed by physical gold and silver.

This avenue enables individuals to transition a portion of their retirement funds into the security of tangible precious metals, fortifying their financial futures.

Ben Shapiro emphasizes with his audience the wisdom of having assets in an area immune to devaluation throughout history.

Gold's enduring value over millennia, irrespective of geographical boundaries or technological advancements, underscores its potential as a haven for preserving wealth.

For more information on gold and how to incorporate it into your retirement portfolio, click here to request a complimentary informational kit. In addition to his influential role as a political commentator, Shapiro is a multifaceted figure, serving as a nationally syndicated columnist, author of numerous books, and a practicing attorney.

Shapiro recently engaged in a discussion with Phillip Patrick, a Precious Metals Specialist from Birch Gold Group, delving into the economic factors propelling gold to record highs. Their dialogue explored topics such as government debt, the global shift away from the dollar, and the growing demand for gold.

.

Pros & Cons of Birch Gold Group

Pros

Numerous 5-star ratings reflect considerable customer contentment and confidence vested in the company.

Birch Gold maintains a transparent fee structure, allowing investors to understand costs upfront

The team at Birch Gold provides personalized service, guiding investors through the account setup process.

Goldco offers on

Birch Gold's precious metals inventory includes a diverse selection of gold, silver, platinum, and palladium.

Cons

The website may overwhelm users with information, potentially leading to confusion.

Birch Gold may receive complaints regarding specific aspects of their service, as with any company

Birch Gold Value Tracking and Consultation

Moving forward from Birch Gold's positive customer ratings and reputation, the focus now shifts to exploring how value tracking and consultation play crucial roles in maximizing your investment potential.

Birch Gold emphasizes the importance of specialist consultation for accurate metal valuation and liquidation processes.

Lend EDU's editorial rating system evaluates Birch Gold based on metals, costs, history, and customer experience, highlighting the significance of seeking expert advice for informed decision-making.

While Birch Gold offers a comprehensive FAQ section covering storage options, liquidation procedures, and metal valuation accuracy, direct consultation with specialists is necessary for tailored guidance.

It's essential to recognize the value of expert advice in navigating the complexities of metal investments and optimizing your portfolio's performance.

Frequently Asked Questions

Owning physical precious metals typically has no legal restrictions. However, some countries may impose limitations on quantities or require reporting for large transactions. Investors should research local regulations and consider storage and security measures when holding physical metals.

There are no clear indications of illegal activities or market manipulation at this time. However, ongoing investigations into secretive gold buyers aim to uncover any potential wrongdoing and ensure market integrity and transparency.

Yes, you can't physically possess the gold in your Gold IRA. The IRS mandates that the precious metals in your IRA be held by a custodian. This ensures compliance with regulations governing self-directed retirement accounts.

You can adjust your Gold IRA investments as often as you like within the constraints of your custodian's guidelines. Stay informed about market trends and your financial goals to make informed decisions for your retirement portfolio.

If your Gold IRA custodian faces bankruptcy, your assets should be safe since they are held separately from the custodian's. Transferring your holdings to a new custodian may be necessary, ensuring your investments remain secure.

Conclusion

Before investing in gold, it's crucial to research carefully. Review market trends, understand gold’s reaction to economic fluctuations, and factor in the costs of a gold IRA. Assess your financial goals and risk appetite to make well-informed decisions, ensuring that gold complements your overall investment approach.

Copyright © Peter G. Sanders 2020